Hi,

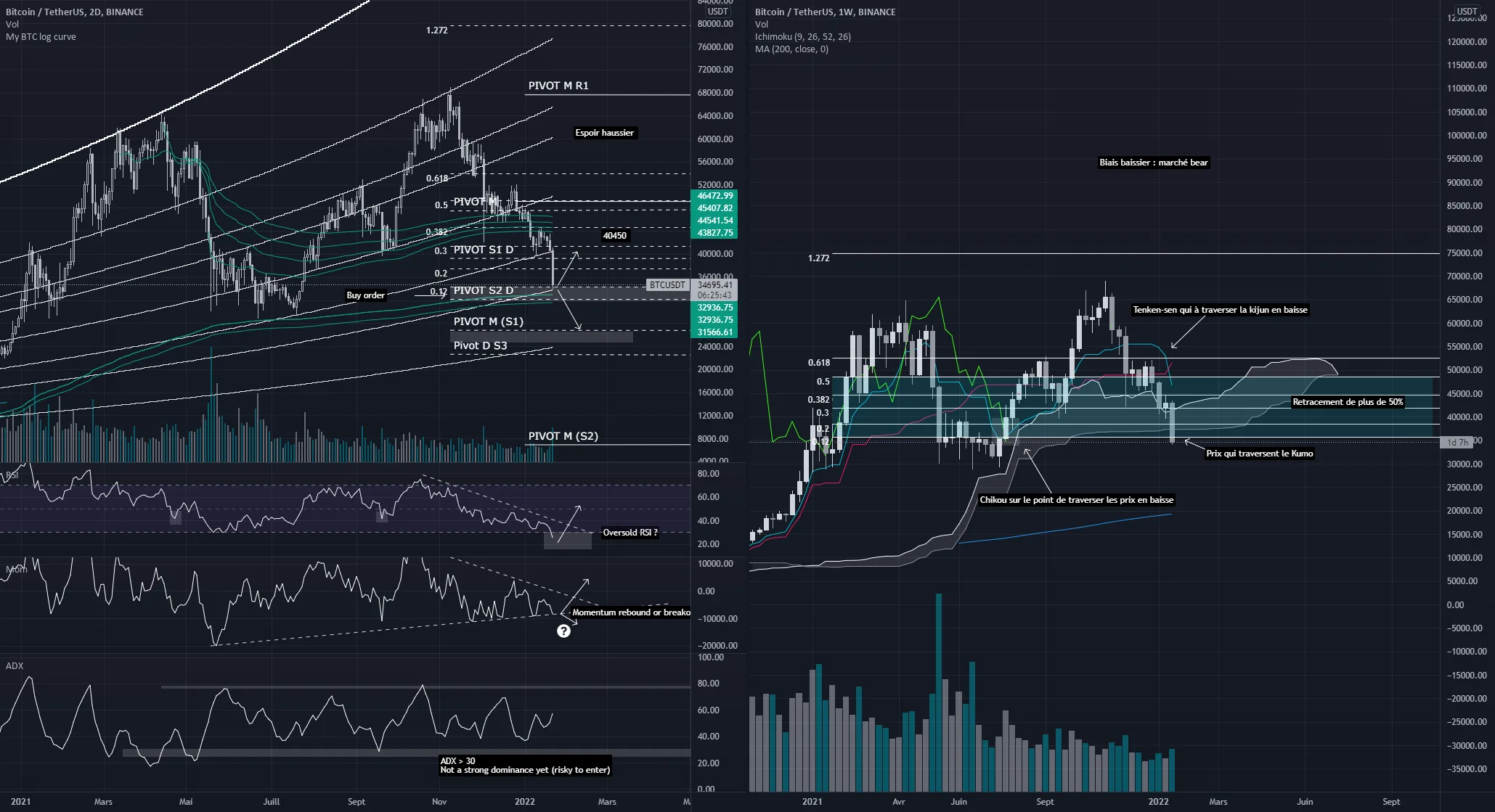

In my last analysis I was on a bullish bias with the possibility of retesting a string down around 38k. I proposed to monitor the breakout RSI and momentum, which did not take place for the entry into position.

The bitcoin have follow the market (S&P500) and have a very strong bearish structure.

Weekly analysis (BEARISH MOVEMENT):

During the week, we can observe the Kijun is about to cross the falling prices which may suggest a decline in prices to come.

We can see that prices are also crossing the KUMO which could signal a strong bearish state.

The tenkan-sen crossed the falling prices (which is weak bearish signals, but combine with others it’s not good news).

Daily analysis :

We crossed the 200 exponential moving average on January 15, which is strong bearish signal.

We have 3 black crows (Candle patterns, strong bearish signal).

The logarithmic formula of BTC announces a possible rebound on current prices, we could then imagine a rebound to KUMO (pullback) 37281.

The RSI show us a strong oversold area which mean, it can be good for an entry.

Strategy :

If you are short, wait the pullback to the Kumo, if you are long it’s very risky because we are against the strong dominance, but you can try a long to the buy zone 34200 -34700 .

I strongly suggest to wait the momentum indicator, (wait for a breakout !) if we have bearishcross then you can short, if we have rebound, it will be a signal to try a smart long.

In any case be very careful,

Hi,

In my last analysis I was on a

bullish bias with the possibility of retesting a string down around 38k. I proposed to monitor the breakout

RSI and momentum, which did not take place for the entry into position.

The

bitcoin have follow the market (

SP500 ) and have a very strong

bearish structure.

Weekly analysis (

BEARISH MOVEMENT):

During the week, we can observe the Kijun is about to cross the falling prices which may suggest a decline in prices to come.

We can see that prices are also crossing the KUMO which could signal a strong

bearish state.

The tenkan-sen crossed the falling prices (which is weak

bearish signals, but combine with others it’s not good news).

Daily analysis :

We crossed the 200

exponential moving average on January 15, which is strong

bearish signal.

We have

3 black crows (Candle patterns, strong

bearish signal).

The logarithmic formula of

BTC announces a possible rebound on current prices, we could then imagine a rebound to KUMO (pullback) 37281.

The

RSI show us a strong oversold area which mean, it can be good for an entry.

Strategy :

If you are short, wait the pullback to the Kumo, if you are long it’s very risky because we are against the strong dominance, but you can try a long to the buy zone 34200 -34700 .

I strongly suggest to wait the

momentum indicator , (wait for a breakout !) if we have bearishcross then you can short, if we have rebound, it will be a signal to try a smart long.

In any case be very careful,